- Published on

Credit Cards and Compound Interest

- Authors

- Name

- Jessie Jimenez

- @JessieDianeJim1

Last time we looked at how long it would take to pay off $1,500 in credit card debt, paying only the monthly minimum of $25.

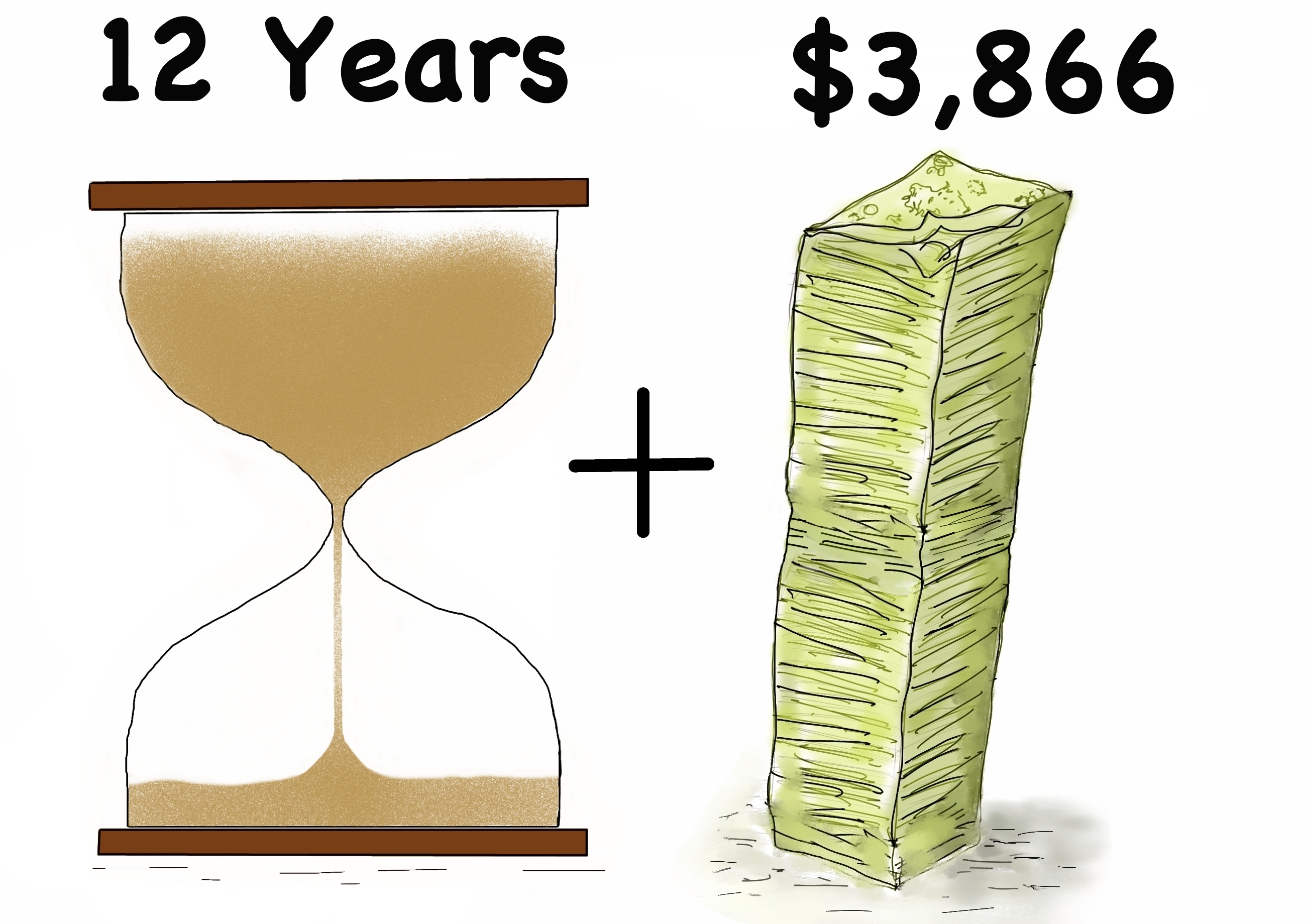

12 years later, the car repair is paid off after shelling out a total of $3,866 in principal and interest combined.

But, the average US family...

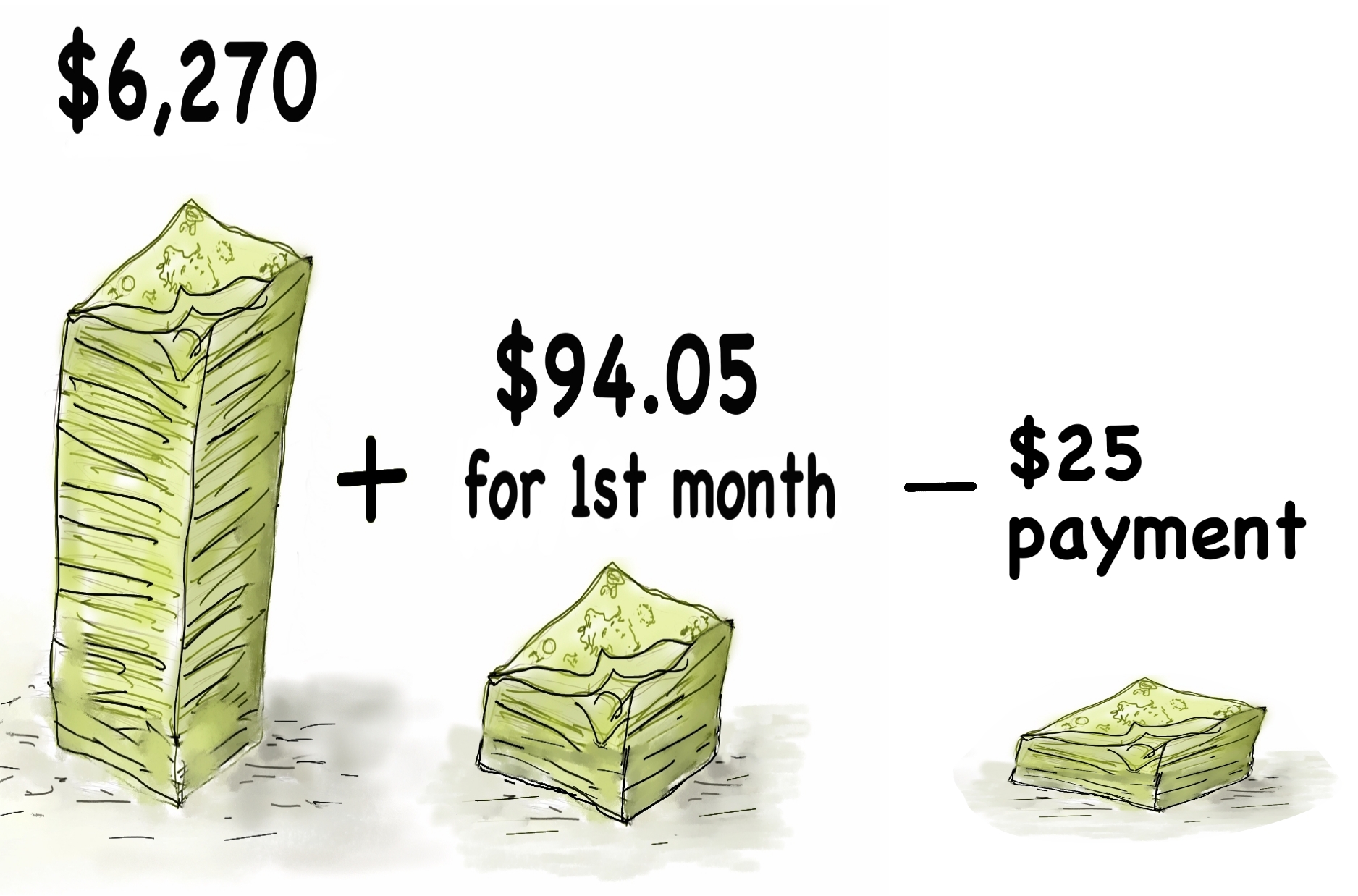

with credit card debt owes $6,270.

So let's say that a few grocery trips, a vacation, and a car repair bill later, Mary's family has this balance on her credit card.

How much will she owe per month if she is paying 18% in interest? (Go back to The Real Cost of Credit Card Debt from June 18th for how we got to 0.015 x the principal.)

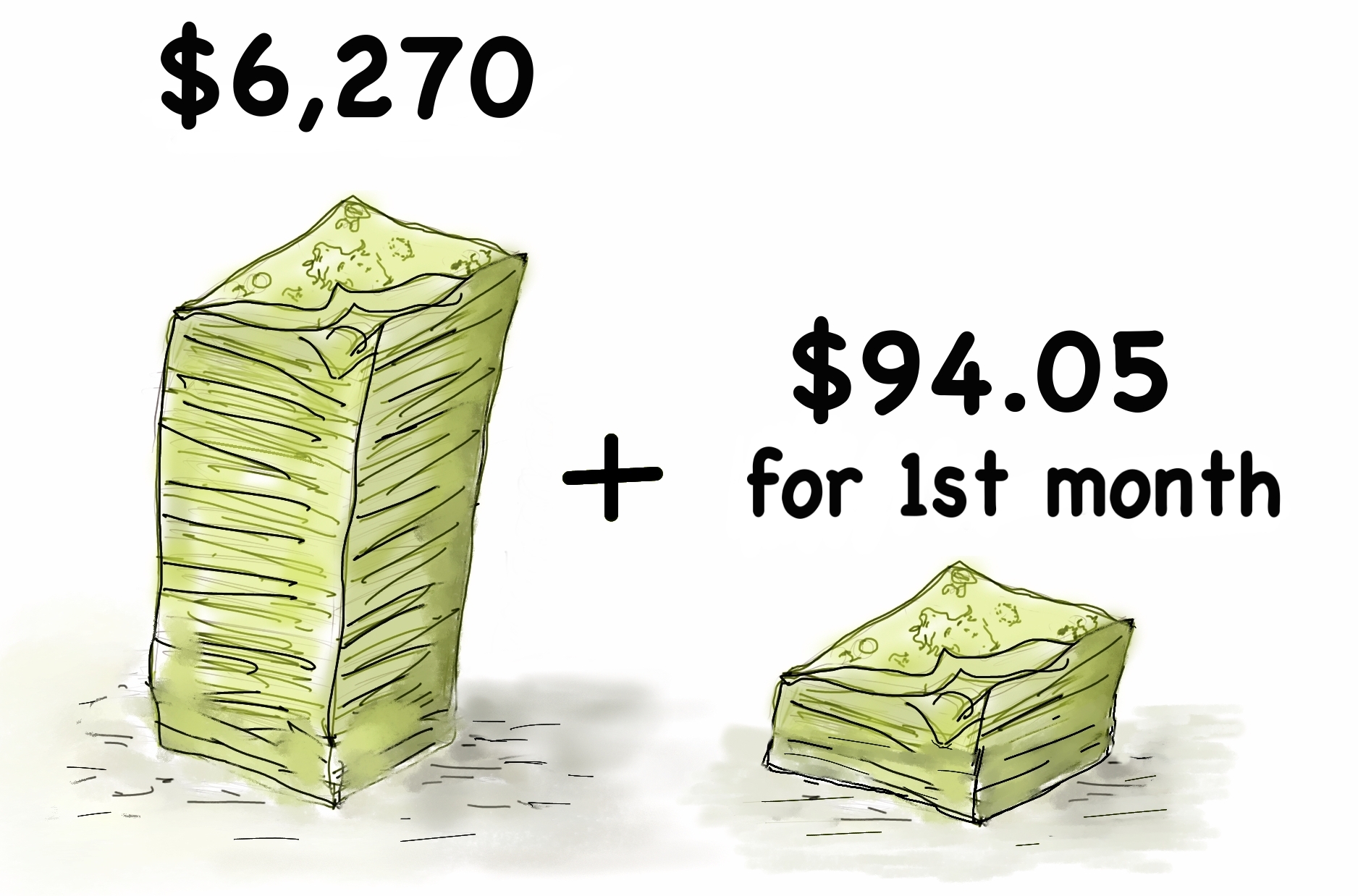

0.015 x $6,270 = $94.05

Now she is looking at $94.05 for the first month in interest.

Still, her kind-hearted credit card company only requires that she pay the same $25 as a minimum payment.

After making this minimum payment, Mary owes more than she did a month ago.

She has only paid a small part of the interest for this month, and none of the principle.

But, the worst part is that next month's interest will come from the new balance. The unpaid interest will join the principal, and Mary will pay even more interest.

0.015 x $6,339.05 = $95.09

Mary will owe $95.09 in interest for next month. Not only will she never pay down the principle or pay off even the interest, she will owe interest on the interest she didn't pay.

This is how compounding works. It's great when you earn it, but devastating when you pay it.

Sources

https://www.creditkarma.com/calculators/debtrepayment

https://www.valuepenguin.com/average-credit-card-debt

https://www.thebalance.com/annual-percentage-rate-apr-315533

https://www.thebalance.com/the-true-cost-of-credit-cards-1289627

https://www.cnn.com/2021/02/22/success/credit-card-payoff-calculator/index.html

https://wallethub.com/edu/cc/average-credit-card-interest-rate/50841